HOW TO WITHDRAW PF AMOUNT ONLINE: HERE ARE SOME IMPORTANT STEPS TO FOLLOW

How to Fill PF Form & Get Claim Online

EPF withdrawal claim is made by an employee if he is unemployed or at the time of retirement. You can make a withdrawal claim by filling the EPF withdrawal form online. Note that you can use the online withdrawal claim facility only if your Aadhaar is linked with your UAN.

PF Withdwaral Online Procedure

Follow the steps given below to fill the EPF withdrawal form and initiate a claim online:-

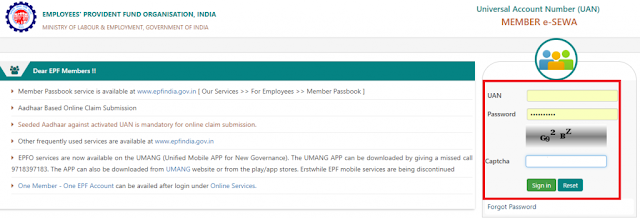

Step 1- Sign in to the UAN Member Portal with your UAN and Password.

UAN Member Portal

Step 2- From the top menu bar, click on the ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.Click Claim (Form-31, 19 & 10C) for EPF withdrawal

Step 3- Member Details will be displayed on the screen. Enter the last 4 digits of your bank account and click on “Verify”

Step 4- Click on “Yes” to sign the certificate of undertaking and proceed further

Step 5- Now click on the “Proceed for Online Claim” option

Step 6- Select “PF Advance (Form 31)” to withdraw your funds online

Step 7 – A fresh section of the form will be opened from where you have to select the “Purpose for which advance is required”, the amount required and the employee’s address

Step 8 – Tick on the certification and submit your application

Step 9 – You may have to submit scanned documents depending on the purpose for which you have filled the form

Step 10 – Your employer has to approve your withdrawal request after which the money will be withdrawn from your EPF account and deposited in the bank account mentioned at the time of filling the withdrawal form.

An SMS notification will be sent to your mobile number registered with EPFO. Once the claim is processed, the amount will be transferred into your bank account. The money usually gets credited within 15-20 days, although no formal time limit has been provided by the EPFO.

EPF Withdrawal Forms

At the time of filing an online withdrawal claim, you will find three EPF withdrawal forms –

PF Advance (Form – 31)

Only PF Withdrawal- Form 19

Only Pension Withdrawal- Form 10C

No comments:

Write Comments