Payment of Bonus Act

Services We Offer

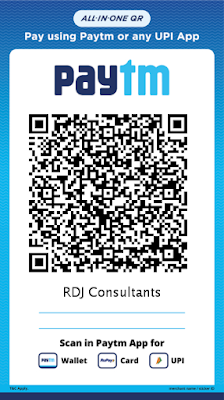

We are Labour Law Consultants and at RDJ Consultants weprovide following services in compliance to the provisions of Payment of Bonus Act, 1965:THE PAYMENT OF BONUS ACT, 1965

The payment of bonus act , 1965 provides for the payment of bonus to persons employed in certain establishment, Employing 20 or more persons, on the basis of profit or on the basis of production or productivity and matters connected there with.

Payment of minimum and Maximum Bonus

the minimum bonus of 8.33% is payable by every industry and establishment under section 10 of the Act. The Maximum bonus including productivity linked bonus that can be paid in any accounting year shall not exceed 20% of the salary/wages of an employee under the section 31 A of the Act.

Applicability of the Act

The Payment of Bonus Act applicable to the following are listed below:

1.It applies to any factory or establishment containing twenty or more workers employed on any day during the year.

The act does not apply to the non-profit making organisations.

1.It is not applicable to establishments such as LIC, hospitals which are excluded under section 32.

2.It is not applicable to establishments where employees have signed an agreement with the employer.

3.It is not applicable to establishments exempted by the appropriate government like sick units.

Objectives of the Act

The objective of the payment of Bonus Act are given bellow as follows:

- To impose a legal responsibility upon an employer of every establishment covered by the Act to pay the bonus to employees in an establishment.

- To designate the minimum and maximum percentage of bonus.

- To prescribe the formula for calculating bonus.

- To provide redressal mechanism.

Disqualification of Bonus

The employees cannot utilize the bonus in case of undergoing with the following activities such as dishonesty, theft, sabotage of any property of establishment, violent behavior while on the premises of the establishment.

Computation of Bonus

As per the Section 4 and section 7 together with the schedule 1 and two deal with the calculation of gross profit and available surplus out of which 67% in case of companies and 60% in other cases would be allocable surplus.

To compute the available surplus the sums, so deductible from the gross profits are:

- All direct taxes under section 7

- The sums which are particularized in the schedule

- The allowance for investment or development in which the employer is allowed to deduct from his income under the Income Tax Act.

Available Surplus = Gross Profit – ( deduct) the following :

- Depreciation is allowable in section 32 of the Income-tax Act.

- Development Allowance.

Details of amendments to the payment of Bonus Act,1965:

The Last Amendements of 2015 was notified on 1st jan. 2016 and is effective from 1st April, 2014

- Bonus Rule

- Bonus Return form

- Bonus Calculation

- Bonus Wage Limit

- Bonus Notification/Circular

- Bonus Applicability

Providing day to day consultancy on matters pertaining to payment of bonus.

- Assistance in treatment of available surplus / allocable surplus like set-on, set-off, carry forward & calculation of accurate amount of bonus.

- Obtaining permissions from Labour Commissioner from time to time for various purposes as may be provided under the act like change in accounting year etc.

- Preparation & Maintenance of various Registers like Register of Allocable Surplus, Register of set on & set off of Allocable Surplus, Register of Bonus etc. as provided under the act.

- Preparation & Submission of Annual return as prescribed under the act.

- Replying / Satisfying Show Cause Notices issued by Inspector.

- Representing establishments before Inspector.

- Assistance to establishments at the time of inspection and search of any premises by Inspector.

- Representing establishments at the enquiries conducted by the inspector.

Request A Quote

Labour Law Consultant, Employee's Provident Fund (EPF), Employee's State Insurance Corp. (ESIC) Maintenance of Records for various Labour Laws i.e. Employees Provident Fund & Miscellaneous Provisions Act, Employees State Insurance Act., Factories Act, 1948, Payment of Wages Under Minimum Wages Act, Bonus Act and Complete services for Payroll, TDS and Professional Tax etc.

Labour Law Consultant, Employee's Provident Fund (EPF), Employee's State Insurance Corp. (ESIC) Maintenance of Records for various Labour Laws i.e. Employees Provident Fund & Miscellaneous Provisions Act, Employees State Insurance Act., Factories Act, 1948, Payment of Wages Under Minimum Wages Act, Bonus Act and Complete services for Payroll, TDS and Professional Tax etc.

SERVICE AREA

RDJ Consultants is one of the leading Bonus Consultant in Delhi & NCR, Gurgaon, Noida, Faridabad and Bahadurgah there are many reputed clients in various places like Okhla, Lajpat Nagar, Mohan Co-Operative Mathura Road, Jung Pura, Nehru Place, Saket, Wazirpur, Mayapuri, Naraina, Rohini, Pitampura, Rajouri Garden, Chhatarpur, Azadpur, Karol Bagh, Rajendra Place, Karampura, Kirti Nagar, Najafgarh, Dwarka, Kapashera, Laxmi Nagar, Shahdra, Uttam Nagar, Janak Puri, Vikas Puri, Palam, Mehrauli, Sangam Vihar, Saini farm, Badarpur Border, jaitpur, Sriniwaspuri, Nandnagari, Tis Hazari, Bawana, Nangloi, Mahipalpur, R K Puram, Vasant Kunj, Sarita Vihar, Lado Sarai, District Centre, Tilak Nagar, Ghitorni, Ashok Vihar, Mayur Vihar, Kalkaji, Safdarjung, Green Park.

No comments:

Write Comments