TDS

Tax Deduction at Source

Labour Law Consultant, Employee's Provident Fund (EPF), Employee's State Insurance Corp. (ESIC) Maintenance of Records for various Labour Laws i.e. Employees Provident Fund & Miscellaneous Provisions Act, Employees State Insurance Act., Factories Act, 1948, Payment of Wages Under Minimum Wages Act, Bonus Act and Complete services for Payroll, TDS and Professional Tax etc.

TDS

Tax deducted at source (TDS), as the very name implies aims at collection of revenue at the very source of income. It is essentially an indirect method of collecting tax which combines the concepts of "pay as you earn" and "collect as it is being earned." Its significance to the government lies in the fact that it prepones the collection of tax, ensures a regular source of revenue, provides for a greater reach and wider base for tax. At the same time, to the tax payer, it distributes the incidence of tax and provides for a simple and convenient mode of payment. The concept of TDS requires that the person on whom responsibility has been cast, is to deduct tax at the appropriate rates, from payments of specific nature which are being made to a specified recipient. The deducted sum is required to be deposited to the credit of the Central Government. The recipient from whose income tax has been deducted at source, gets the credit of the amount deducted in his personal assessment on the basis of the certificate issued by the deductor.

- Providing of employees Tax calculation sheet through e-mail.

- Liaise with HR/Accounts dept. to ensure that tax saving investments and supporting have been properly declared/provided by the employees and also checking the validity of documents provided by the employees for tax saving.

- Preparation & filing of Quarterly/Annual return of salary (Form No.24Q) under Income Tax Act 1961.

- Providing of Form No.16 & Form 12BA for individual employees.

- Updating & Suggestion for Tax planning on periodic development on taxation matters.

TDS due date

TDS has two due dates they are TDS payment due date and TDS return due date. Both have different due dates for every month.

TYPE OF DUE DATE

TDS payment On or before 7th of every month

For the month of March, on or before April 30th

TDS return On or before 31st of the next month after quarter end

Ex: Apr-Jun, file on or before 31st July

For the 4th quarter i.e., Jan-Mar file on or before 31st May

TDS Interest

TYPE PENALTYLate deduction 1% per month

Late payment 1.5% per month

Late filing Rs. 200 per day

Note: Maximum interest payable will be equal to tax payable

For More Details Visit www.bestesipfconsultant.com

SERVICE AREA

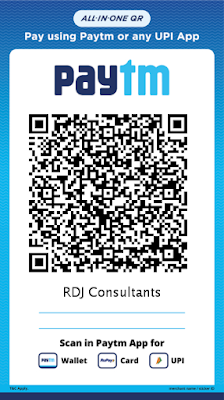

RDJ Consultants is one of the leading TDS Consultant in Delhi & NCR, Gurgaon, Noida, Faridabad and Bahadurgah there are many reputed clients in various places like Okhla, Lajpat Nagar, Mohan Co-Operative Mathura Road, Jung Pura, Nehru Place, Saket, Wazirpur, Mayapuri, Naraina, Rohini, Pitampura, Rajouri Garden, Chhatarpur, Azadpur, Karol Bagh, Rajendra Place, Karampura, Kirti Nagar, Najafgarh, Dwarka, Kapashera, Laxmi Nagar, Shahdra, Uttam Nagar, Janak Puri, Vikas Puri, Palam, Mehrauli, Sangam Vihar, Saini farm, Badarpur Border, jaitpur, Sriniwaspuri, Nandnagari, Tis Hazari, Bawana, Nangloi, Mahipalpur, R K Puram, Vasant Kunj, Sarita Vihar, Lado Sarai, District Centre, Tilak Nagar, Ghitorni, Ashok Vihar, Mayur Vihar, Kalkaji, Safdarjung, Green Park.

No comments:

Write Comments