Employee Provident Fund

EPF & MP Act, 1952

Employees Provident Fund is established in 1952 and hence the act is named as Employees Provident Fund & Miscellaneous Provisions Act, 1952, which extend to the whole of India except Jammu & Kashmir.

Employee Provident Fund (EPF)

Provident fund is a welfare scheme for the benefits of the employees. Under this scheme both the employee & employer contribute their part but whole of the amount is deposited by the employer. Employer deducted the employee share from the salary of the employee. The interest earned on this investment is also credited in pf account of the employees. At the time of retirement, the accumulated amount is given to the employees, if certain conditions are satisfied.Applicability of the Act

It is applicable:a) Every factory engaged in any industry specified in Schedule 1 in which 20 or more persons are employed;b) Every other establishment employing 20 or more persons or class of such establishments which the Central Govt. may notify;c) Any other establishment so notified by the Central Government even if employing less than 20 persons.

Every employee, including the one employed through a contractor (but excluding an apprentice engaged under the Apprentices Act or under the standing orders of the establishment and casual laborers), who is in receipt of wages up to Rs.15,000 p.m., shall be eligible for becoming a member of the funds.

Types of Provident fund

- Statutory Provident Fund (SPF)

- Public Provident Fund (PPF)

- Recognised Provident Fund (RPF)

- Unrecognised Provident Fund (URPF)

PF Contribution Rate

PF contribution paid by the employer and employee is 12% of (basic salary + dearness allowance + retaining allowance). Equal contribution is payable by the employee and employer. In case of establishments which employs less than 20 employees or meet certain other conditions, as per the EPFO rules, the contribution rate for both employee and the employer is restricted to 10%. For most employees working in the private sector, it’s the basic salary on which the contribution is calculated.

It is necessary that employees’ drawing less than Rs 15,000 per month, to become members of the EPF. As per the guidelines in EPF, employee, whose ‘basic pay’ is more than Rs. 15,000 per month, at the time of joining, is not required to make PF contributions. However, an employee who is drawing a pay of more than Rs 15,000 can still become a member and make PF contributions, with the consent of the Employer and Assistant PF Commissioner.

Necessary Following Documents for PF Registration

1. Pan No. Company/Firm/Proprietor

2. Memorandum

3. Bank Details

4. Salary Sheet

5. All Director/Partner/Proprietor Aadhar No.

6. All employees’ Aadhar/Pan/Bank details

7. Rent Agreement/Lease Agreement

8. Telephone Bill/Electricity Bill/Water Bill

9. Copy of Registration GST

10. Digital Signature

11. Twenty Letter Heads

PF Rule (Compliances)

All employees have to be covered under this scheme including director/Partner.

PF Challan ECR Return has to be deposited every month.

UAN Records has to be Updated/ Activated.

Form No. 2 Nomination & Declaration

Form No. 3A Employee Contribution Card

Statement IW-1 Employee qualifying for membership as International Worker

Form No. 11 Declaration by employees

Form No. 5 Return of Employees Qualifying for Membership

Form No. 10 Return of the Member Leaving Service

Form No. 9 Revised

Form No. 19 has to be submitted for withdrawal.

Form No. 10C has to be submitted for withdrawal.

Form No. 10D Pension Claim Forms

Form No. 6 Return of Contribution Card

Form No. 6A Annual Contribution Card

Form No. 5A Return of Ownership

Form No. 5IF has to be submitted.

Form No. 13 Application for transfer of EPF Account

Form No. 20 Withdrawal form in case of Death

Form No. 31 has to be submitted for Advance

Form No.3 Pension Scheme Consolidated Return

Form No. 4 Pension Scheme Return of Employees Qualifying for Membership

Form No. 5 Pension Scheme Return of the Member Leaving Service

Form No. 7 Pension Scheme Emloyee Contribution Card

Form No. 8 Pension Scheme Annual Statement of Contribution

PF Pension calculation certificate has to be obtained

Pension Calculation formula

Proceeding under Section 7A procedure has to be attended

Proceeding under Section 14B & 7Q has to be attended

Calculation of Damage & Interest

Case proceeding under any provision of the PF has to be represented by the Advocate/Authorized Representative.

PF Trust has to submit Separate ECR Challans and Returns

PF Trust has to file application for exemption

PF benefits

PF Provision Coverage

PF Final Coverage

PF Voluntarily Registration procedure

PF Wage limit

Letter to PF Office for changein Name and Other details

Joint Request Letter

Eligibility Register of Employees for PF

For More Details Visit www.bestesipfconsultant.com

For More Details Visit www.bestesipfconsultant.com

Labour Law Consultant, Employee's Provident Fund (EPF), Employee's State Insurance Corp. (ESIC) Maintenance of Records for various Labour Laws i.e. Employees Provident Fund & Miscellaneous Provisions Act, Employees State Insurance Act., Factories Act, 1948, Payment of Wages Under Minimum Wages Act, Bonus Act and Complete services for Payroll, TDS and Professional Tax etc.

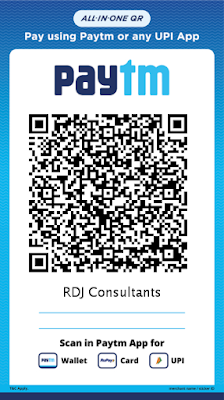

SERVICE AREA

RDJ Consultants is one of the leading PF Consultant in Delhi & NCR, Gurgaon, Noida, Faridabad and Bahadurgah there are many reputed clients in various places like Okhla, Lajpat Nagar, Mohan Co-Operative Mathura Road, Jung Pura, Nehru Place, Saket, Wazirpur, Mayapuri, Naraina, Rohini, Pitampura, Rajouri Garden, Chhatarpur, Azadpur, Karol Bagh, Rajendra Place, Karampura, Kirti Nagar, Najafgarh, Dwarka, Kapashera, Laxmi Nagar, Shahdra, Uttam Nagar, Janak Puri, Vikas Puri, Palam, Mehrauli, Sangam Vihar, Saini farm, Badarpur Border, jaitpur, Sriniwaspuri, Nandnagari, Tis Hazari, Bawana, Nangloi, Mahipalpur, R K Puram, Vasant Kunj, Sarita Vihar, Lado Sarai, District Centre, Tilak Nagar, Ghitorni, Ashok Vihar, Mayur Vihar, Kalkaji, Safdarjung, Green Park.

No comments:

Write Comments